What Is LIFO Method? Definition and Example

According to this rule, management is forced to consider the utility of increased cash flows versus the effect LIFO will have on the balance sheet and income statement. Some of the more important problems include the effects of prices, LIFO liquidation, purchase behavior, and inventory turnover. The cost of materials is charged to production in the reverse order of purchases. They should be entered in the materials ledger card balance below all of the units on hand, at the same price as they were when issued to the factory. In other words, under the LIFO method, the cost of the most recent lot of materials purchased is charged until the lot is exhausted. With first in, first out (FIFO), you sell the oldest inventory first—and with LIFO, you sell the newest inventory first.

Do you own a business?

You neither want to understate nor overstate your business’s profitability. This is why choosing the inventory valuation method that is best for your business is critically important. Learn which inventory valuation method will boost your profits and lower your tax burden. However, for investors and government agencies, the accounting can misrepresent financial aspects of the company, which isn’t always great. The last in, first out method of inventory accounting makes the assumption that the item most recently placed into inventory, whether it was created or acquired, is the first to be sold. Although this is an uncommon practice in real life, it can provide some tax benefits to companies with significant inventories.

Beyond tax impact

- Therefore, when COGS is lower (as it is under FIFO), a company will report a higher gross income statement.

- During her first term, she helped pass universal paid family and medical leave across the state.

- The type of inventory that a business holds can influence its choice of FIFO or LIFO.

- Also, once you adopt the LIFO method, you can’t go back to FIFO unless you get approval to change from the IRS.

Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn. Let’s say you’ve sold 15 items, and you have 10 new items in stock and 10 older items. You would multiply the first 10 by the cost of your newest goods, and the remaining 5 by the cost of your older items to calculate your Cost of Goods Sold using LIFO.

Implementing FIFO or LIFO in your business

Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. When she’s away from her laptop, she can be found working out, trying new restaurants, and spending time with her family. Once a police officer in New York state and Border Patrol agent, the Obama administration tapped him to head Immigration and Customs Enforcement’s deportation branch in 2013. During Homan’s time at ICE under President Obama, the agency carried out record numbers of formal deportations. Obama gave Homan a Presidential Rank Award, the highest civil service recognition. This year’s tournament has record prize money, with the singles champion set to collect about £4m.

Once the value of ending inventory is found, the calculation of cost of sales and gross profit is pretty straight forward. The first step is to note the additions in inventory in the types of business bank accounts left column, along with the purchase cost for each day. For example, on the first day, 10 units of inventory were added at the cost of $500 each, which we will record as follows.

LIFO usually doesn’t match the physical movement of inventory, as companies may be more likely to try to move older inventory first. However, companies like car dealerships or gas/oil companies may try to sell items marked with the highest cost to reduce their taxable income. FIFO can be a better indicator of the value for ending inventory because the older items have been used up while the most recently acquired items reflect current market prices. Since LIFO uses the most recently acquired inventory to value COGS, the leftover inventory might be extremely old or obsolete. As a result, LIFO doesn’t provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today’s prices.

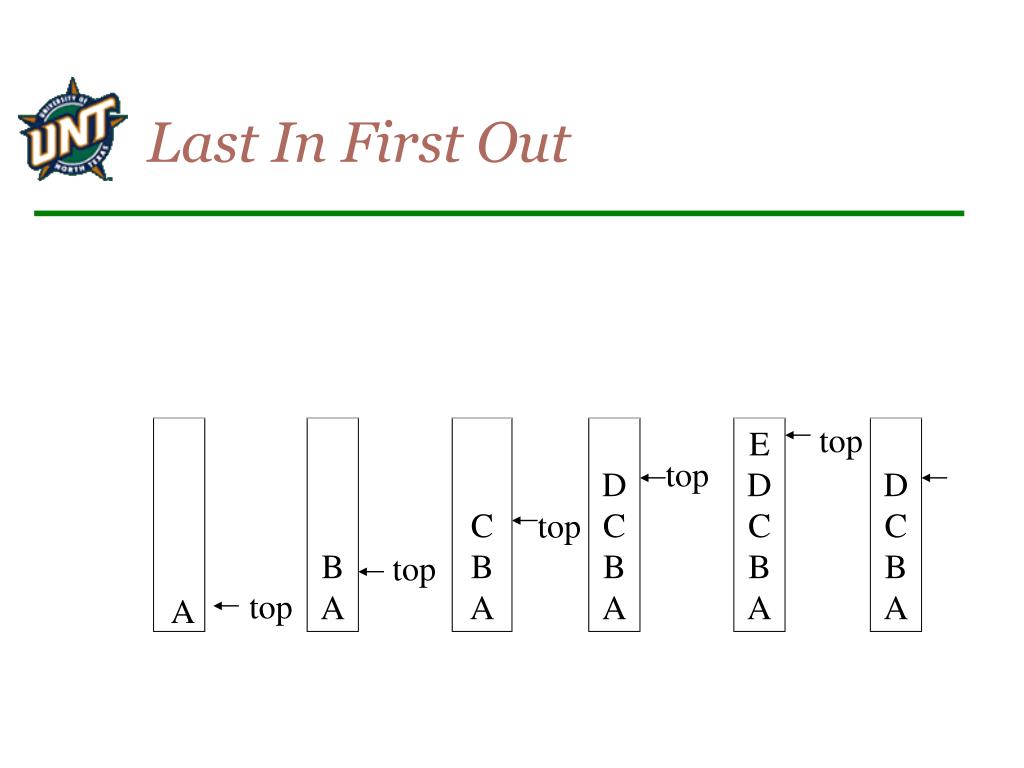

LIFO, short for Last In First Out, is a method used for inventory valuation. In simple terms, it means that the last items added to an inventory are assumed to be the first ones sold. Picture a stack of trays in a cafeteria—the last tray placed on top is the first one taken by the next person in line. Similarly, in LIFO, the most recently acquired inventory items are considered to be the first ones sold or used. Besides minimizing tax obligations, LIFO can also wreak havoc on inventory valuations when an industry is experiencing strong inflation or declining values.

A company generates the same amount of income and profits regardless of whether they use FIFO or LIFO, but the different valuation methods lead to different numbers on the books. This can make it appear that a company is generating higher profits under FIFO than if it used LIFO. The type of inventory that a business holds can influence its choice of FIFO or LIFO. For example, businesses with a beginning inventory of perishable goods will usually choose FIFO, since it’s in their best interest to sell older products before they expire. Using the appropriate inventory valuation system can help track real inventory management practices. When the inventory units sold during a day are less than the units purchased on the same day, we will need to assign cost based on the previous day’s inventory balance.

Later, you restock the same action figure at a higher cost of $12 per unit, buying 30 more units. Now, if you sell 40 action figures, according to the LIFO method, you assume that the last 40 units you purchased at $12 each are the ones sold. This means your cost of goods sold (COGS) would be calculated based on the $12 price, even though you still have the cheaper $10 units in your inventory. To calculate FIFO, multiply the amount of units sold by the cost of your oldest inventory. If the number of units sold exceeds the number of oldest inventory items, move on to the next oldest inventory and multiply the excess amount by that cost. The principle of LIFO is highly dependent on how the price of goods fluctuates based on the economy.

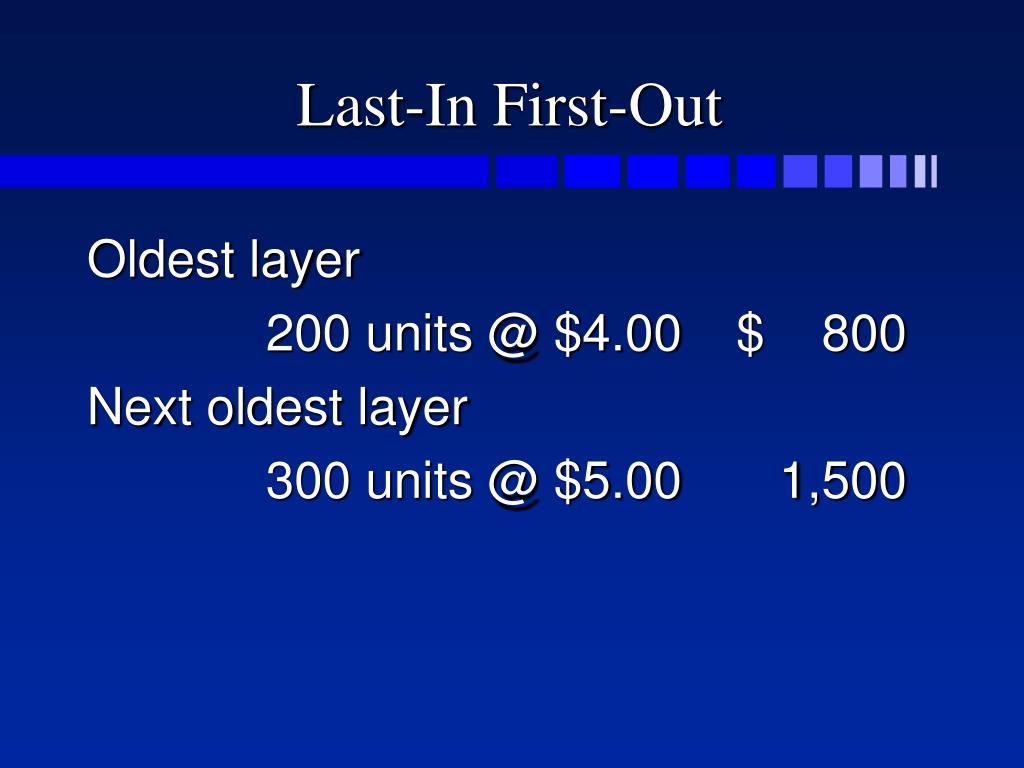

The average inventory method usually lands between the LIFO and FIFO method. For example, if LIFO results the lowest net income and the FIFO results in the highest net income, the average inventory method will usually end up between the two. During 2018, inventory quantities were reduced, resulting in the liquidation of certain LIFO inventory layers carried at costs that were lower than the cost of current purchases.