Cash Book in Accounting

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial tax day trivia information to millions of readers each year. If desired, the area for the name of the account in this column can be replaced with an area for account numbers.

How confident are you in your long term financial plan?

In other words, this journal is used to record all cash that comes into the business. For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used. For example, the cash sale on June 1 is recorded in the cash receipts journal by first entering June 1 in the date column. The amount of $506 is then placed in both the cash debit column and the sales credit column. The other side of the two column cashbook ledger would be headed ‘Credit’ and show an identical format with the two columns representing the monetary amount of the cash payment and the monetary amount of the discount received.

Post navigation

Thegeneral journalis the all-purpose journal that all transactions are recorded in. Since all transactions are recorded in the general journal, it can be extremely large and make finding information about specific transactions difficult. That is why the general journal is divided up into smaller journals like the sales journal, cash receipts journal, and purchases journal.

Combination of cash and credit

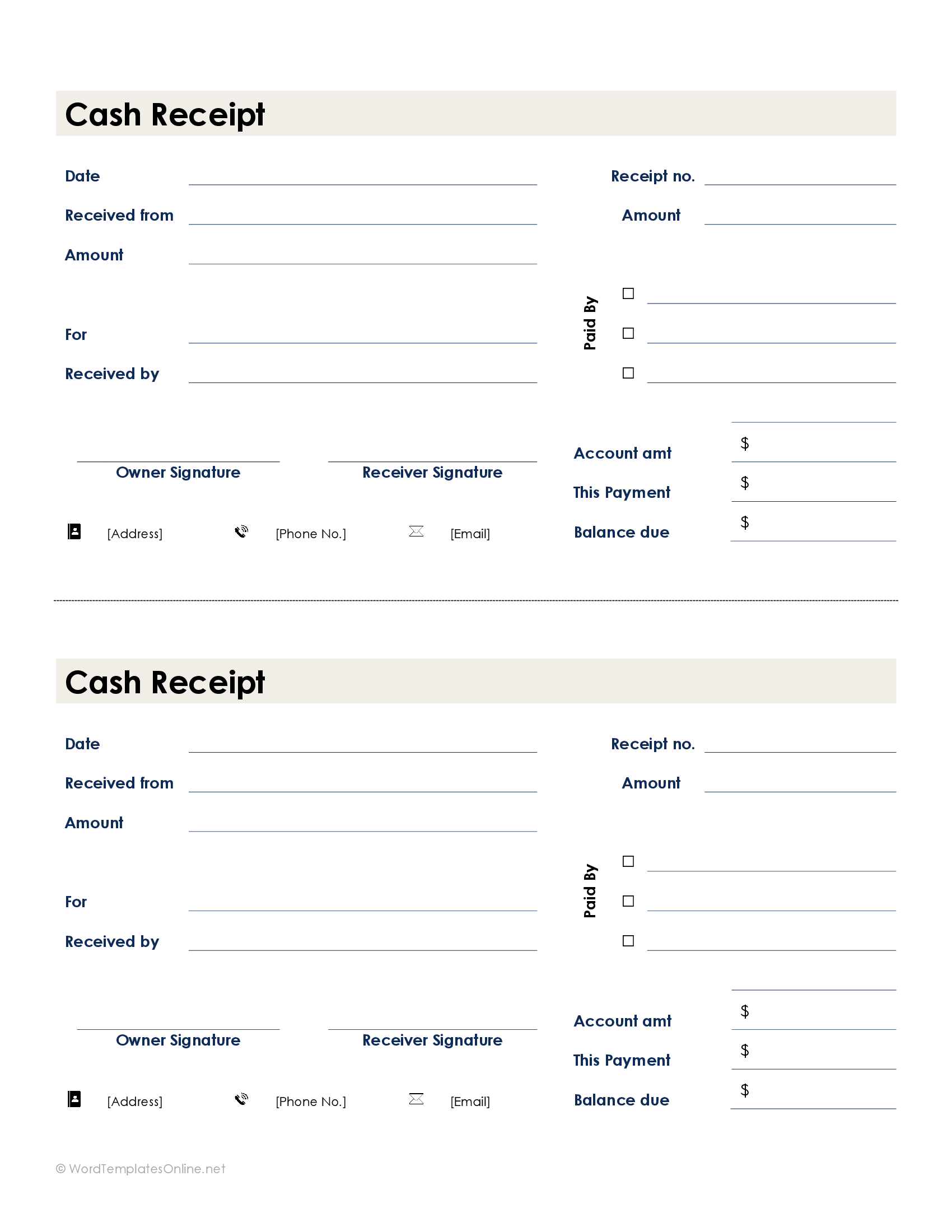

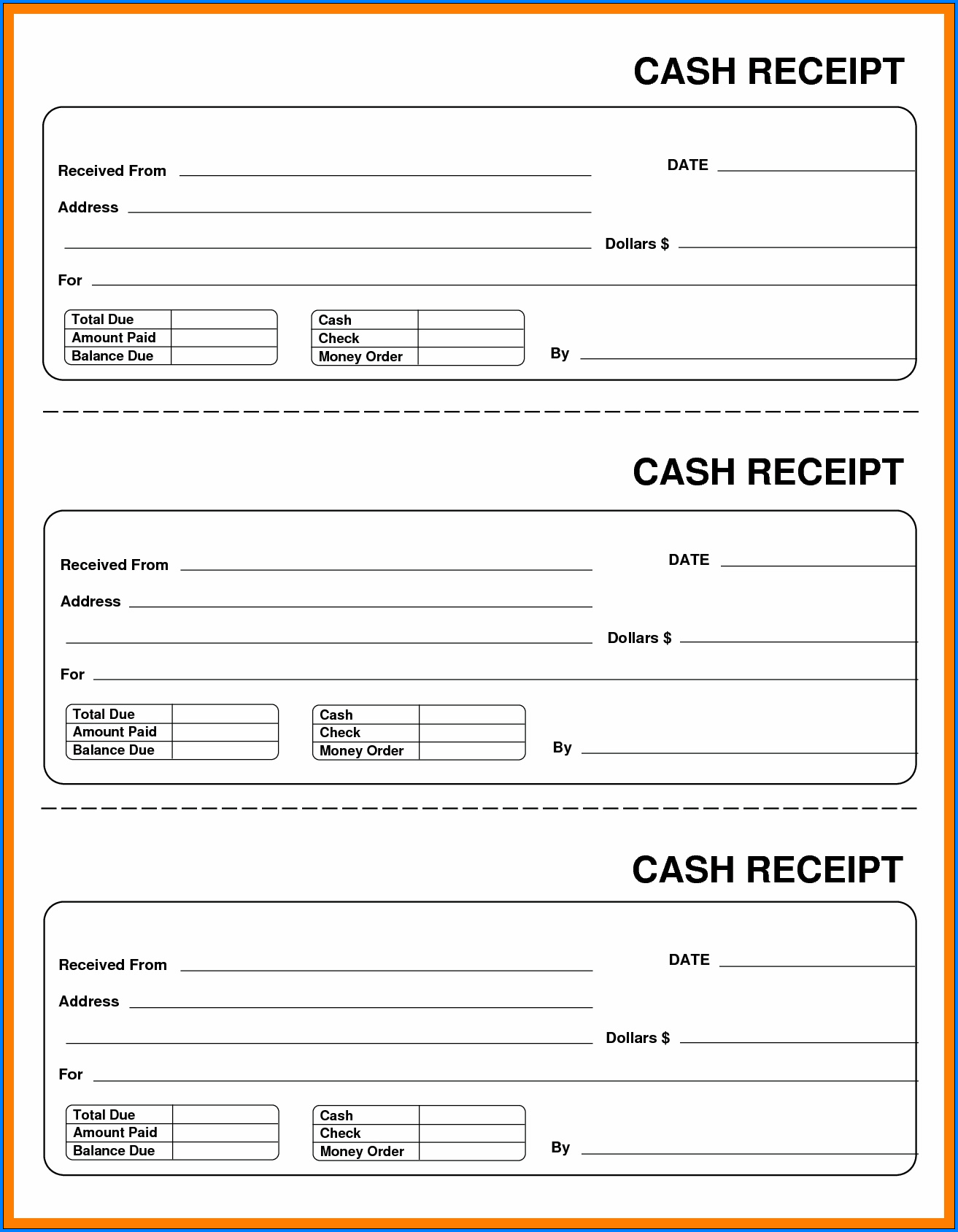

The cash receipts journal is an important tool to keep track of cash collected by a business. This entry records the amount of money the customer owes the company as well as the revenue from the sale. In reality, accounting transactions are recorded by making accounting journal entries.

How do you write a sales journal?

Cash sales work on the cash basis of accounting, and credit sales on the accrual basis of accounting. Alternatively the business can use the additional column of the two column cashbook ledger to operate as a bank journal. It should be noted that when the cashbook is used as a subsidiary ledger the discount column is still not part of the double entry.

Double Entry Bookkeeping

Because accounting transactions always need to remain in balance, there must be an opposite transaction when the cash is posted. When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed. Purchase credit journal entry is recorded in the books of accounts of the company when the goods are purchased by the company on credit from the third party (vendor).

- You may sell items or provide services that people pay for with cash, which may range from food or books to massages or even a ride in a taxicab.

- When cash is received, one of the other accounts – sales, accounts receivable, inventory – must also have a transaction listed.

- Again, for simplicity, the two column cashbook ledger diagram below shows only one side of the cashbook, in this case the left hand receipts side (debit) .

The two columns referred to in the name of this cashbook are the monetary amount of the cash receipt (Cash), and the monetary amount of the discount allowed (Discount) both highlighted in gray. The business can use the additional column to operate as a discounts journal. This columns records details of discounts allowed on the cash receipts side of the cashbook and discounts received on the cash payments side of the cashbook. The total from each column in a cash receipts journal is posted to the appropriate general ledger account.

Since the cost of sales is essentially the cost of doing business, it is recorded as a business expense on the income statement. You typically have many cash receipts during the day for toy, books and candy. You keep track of your sales in your cash register every day and then manually post the day’s transactions at the end of the day. At the close of business today, you are ready to review your day’s business and make the appropriate entries in your accounting records. In accounting, journals are used to record similar activities and to keep transactions organized.

Journal and Ledger are the two pillars which create the base for preparing final accounts. The Journal is a book where all the transactions are recorded immediately when they take place which is then classified and transferred into concerned account known as Ledger. A general journal is used to record unique journal entries that cannot be processed in a more efficient manner. For example, checks written, sales invoices issued, purchase invoices received, and others can be recorded in a computerized accounting system when the documents are processed. Recording cash receipts offsets the accounts receivable balance from the sale. The cash receipts journal ignores the accrual basis of accounting, which serves as the foundation for sound accounting and double-entry bookkeeping.